Wrapup 2024 and What's Ahead for 2025

Market predictions are bullshit, but here's more bullshit anyway.

Disclaimer Alert: Finance, Fun, and Fiction. Just bullshit. Fyi, I journal for my own fun.

Last year:

Everything is idiotic and Signal is completely lost. From the 2022 bear market despair to today's euphoric "greatest bull run ever" screaming - the clown show continues exactly as predicted. While everyone's masturbating over predictions to get rich quick, here's the reality check: you spineless idiots will blow up your accounts the moment you see any real gains.

The world's gone full retard - media, X/Twitter, crypto bros, investment "gurus" - it's all noise amplified by NPCs. When people casually walk past someone burning in the metro to take photos, it’s over.

My 2025 strategy remains unchanged:

Stack knowledge

Grow capital (your shield against widespread stupidity)

Zero debt

Live lean

Keep emergency funds ready

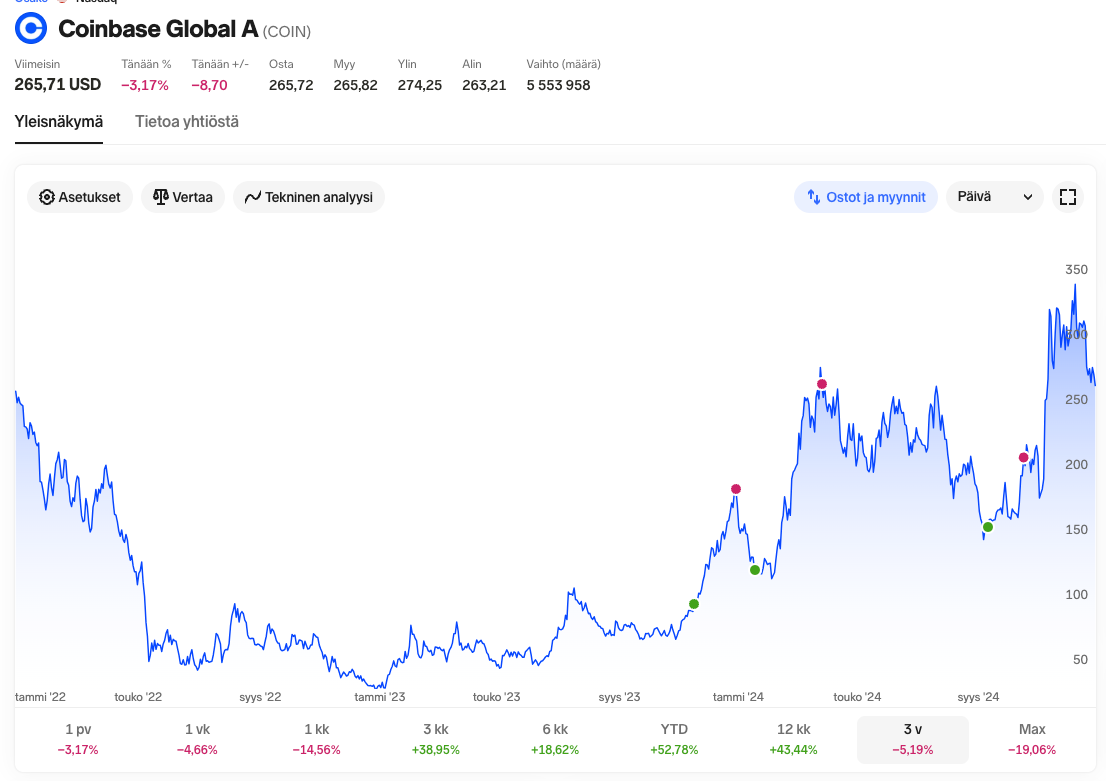

The market? PLTR and Coinbase were fun rides in 2024, but let's be real - risk/reward is shit now. Valuations are in la-la land. Sure, the AI narrative might push concentration to even more insane 1929-style levels, but betting on that is pure gambling.

Buy low - Sell high still works - it's just that nothing's low right now.

My deepest wish? For this madness to end. We need a proper wipeout to get back to rewarding actual innovation, not this circus. Until then, I'll keep playing the jester in this clown market.

The S&P 500

The S&P500 has returned over 20% in 2023 and 2024. Has this happened before?

1927 & 1928 → Great depression

1935 & 1936 → A severe bear market

1954 & 1955 → Decent gain continued, recession year followed by a huge rebound 1958

1975 & 1976 → 1977 gave back –7%, returns were positive after despite a messy and inflatory decade.

1995 & 1996 → We want a fucking 1995 super boom!

1997 +31.01% Continues strong

1998 +26.67% Another 20%+ year

1999 +19.53% Just under 20%

2000– 10.14% Dot-com crash begins

History rhymes, but does it give any clarity?

AI is a big breakthrough, eg, 1995 interned adoption.

→ Increased productivity → Growth → More earnings

Today's AI narrative feels like 1995's internet. Could this be another multi-year face ripper? Maybe. The dot-com bubble made bears look stupid longer than anyone expected. The most bullish case is a small correction in Q1 2025, then a rocket ship through 2026.

My deepest wish? Total market wipeout. Need to see bears capitulate and bulls get absolutely rekt.

Well, any ideas for 2025?

CHYNA: From AI Hype to China Cope

The key in today’s “investing” is to look beyond these extreme narratives. Are there opportunities?

China's 10Y yield is screaming recession? Property market tits up. Japanification incoming? Maybe. But look at these valuations - BABA trading like the end of the world is guaranteed.

Why China might not be completely fucked:

Still #2 economy globally

Manufacturing dominance

Trump wants deals, not war

Policy tools remain (yes throwing money at problems doesn’t solve everything)

Tech sector still innovating

Key point: You don't need China to solve everything. You just need it to avoid total collapse. High risk of becoming another Value Trap bagholder…

From AI hype to China cope… Maybe I am losing the plot also? If you're seeking deep value thesis about Chinese ADRs, that's not investing anymore - that's a cry for help.

Bitcoin

Bitcoin always feels overvalued in the short term, but it is vastly undervalued in the long term...

Currency crisis. There is a huge desync everywhere.

Look at the currencies and what they are doing. Eur/USD is going to parity. Look at yields, China vs. USA.

When the signal is this lost and the clown world is this intense, maybe it's time to stop playing altogether. Stack sats, and turn off the noise.

The Bitcoin community's gone full retard too… It is all so tiresome.

The Plan

Markets feel toppy. Social media and media are in wholly idiotic mode.

My 2025 playbook:

Focus on building real business

Stack knowledge

Keep powder dry

Plan Finland exit (+3-year horizon)

The signal's so lost in this noise that I'm close to full capitulation. Maybe that's the buy signal?

Sources and good reads.

https://en.wikipedia.org/wiki/1994_bond_market_crisis

https://x.com/shaunrein

His Book, The Split, is good. Yeah, he is super bullish on China, but his media narrative critique is spot-on.

https://x.com/SvetskiWrites

Book. “Bushido of Bitcoin” Surprisingly hopeful without being too cringe. Entertaining to read, helps wash down the white pill.